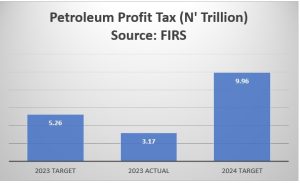

The Nigerian Federal Government is setting its sights on a substantial revenue boost from the oil sector in 2024, with plans to achieve a remarkable 214% increase in Petroleum Profit Tax (PPT) collections. According to data from the Federal Inland Revenue Service (FIRS), the government aims to rake in N9.96 trillion from PPT, representing a significant leap from the N3.17 trillion generated in 2023 and an 89% hike over the initial projection of N5.26 trillion for the same year.

These ambitious targets come against the backdrop of significant fiscal reforms introduced through the Petroleum Industry Act (PIA) in response to challenges posed by declining oil prices. The PIA phased out the Petroleum Profits Tax (PPT) and introduced the Hydrocarbon Tax (HT), aimed at making the Nigerian oil and gas sector more adaptable amidst fluctuating global oil prices.

However, despite these efforts, the Federal Government faced challenges meeting its PPT collection targets in 2023, achieving only around 60% of the projected goal. The sector’s poor tax performance has persisted, with revenue targets consistently being missed. Challenges include lower production levels, conversion of deep offshore licenses under PIA terms, and arrears from the Nigerian National Petroleum Corporation (NNPC).

The Nigerian oil sector, a vital pillar of the country’s economy, continues to grapple with significant challenges, including declining investment, pipeline vandalism, and global geopolitical tensions. Efforts to improve the sector’s performance include enhancing engagement with oil operators, creating a more inviting investment climate, and addressing issues in the Niger Delta region.

However, achieving revenue targets for 2024 may prove ambitious, considering production cuts enforced by OPEC and its allies. As Nigeria navigates these challenges, revitalizing the oil sector remains a critical task for the administration, signaling a period of work and reform ahead under the leadership of Bola Tinubu.

Credit: Nairametrics