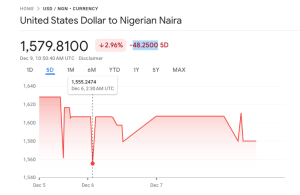

The naira has strengthened significantly following the launch of the Electronic Foreign Exchange Matching System (EFEMS) and the successful $2.2 billion Eurobond issuance by the Nigerian government. On Wednesday, the naira appreciated to ₦1,608/$1 at the Nigerian Foreign Exchange Market (NFEM), improving from ₦1,625/$1 on Tuesday and ₦1,660/$1 on Monday.

EFEMS Boosts Transparency and Liquidity

The Central Bank of Nigeria (CBN) introduced EFEMS earlier this week to improve transparency and curb speculation in the FX market. The platform allows authorised dealers to place buy and sell orders in real-time, automatically matching transactions to ensure efficiency and fairness.

According to a source, the increased transparency has revealed greater dollar liquidity in the banking sector, further bolstering market confidence. Financial experts are optimistic that EFEMS will address persistent FX challenges and provide stability for the naira.

High Yields Attract Foreign Investors

Rising yields on naira-denominated assets have drawn significant interest from Foreign Portfolio Investors (FPIs), leading to increased dollar inflows. Gbolohan Ologunro, portfolio manager at FBNQuest, noted that the one-year treasury bill yield recently peaked at 30.71% before settling at 29.75%, driving record bids of ₦2.53 trillion on Wednesday.

Similarly, OMO auction yields reached 32%, further attracting foreign capital. Uduak Jacob of Comercio Partners Asset Management commented, “FPIs are flooding the market with dollars, anticipating upcoming auctions and leveraging high yields on naira assets.”

Eurobond Proceeds to Support Reserves

Nigeria’s Eurobond issuance, oversubscribed by $9.1 billion, is expected to inject liquidity into the FX market. The Federal Government raised $700 million through 6.5-year bonds at a 9.625% coupon rate and $1.5 billion via 10-year bonds at 10.375%.

Analysts project that proceeds from the Eurobond, expected by December 9, will push Nigeria’s FX reserves to over $42 billion by year-end. This increase could give the CBN more capacity to stabilise the naira, with analysts anticipating reserves could rise to $45 billion by January, sustaining the currency’s appreciation into February.

Credit: Businessday (Text Excluding Headline)